International travel is expected to drive a 5% increase in corporate travel spending.

Corporate expenditure on travel to, from and within Malaysia amounted to US$36 billion (more than 145 billion Malaysia ringgit, or MYR) in 2018. Inbound travelers account for two-thirds of total spending. Malaysians traveling abroad on business account for a further 24%, leaving domestic travel with a 9% share. From 2013 to 2018, overall spending grew just 1% a year, on average. Average annual spending contracted 0.5% for on inbound travel and expanded 2.7% for outbound trips. Domestic travel bucked the trend, growing 14% per year. Corporate travel spending is expected to accelerate 5% through 2023, as international trips pick up.

Download the 2019 Industry Forecast, with region-specific reports and infographics available in six languages. Ask how BCD Travel can help you get travelers to emerging and established markets all over the world.

Economic environment

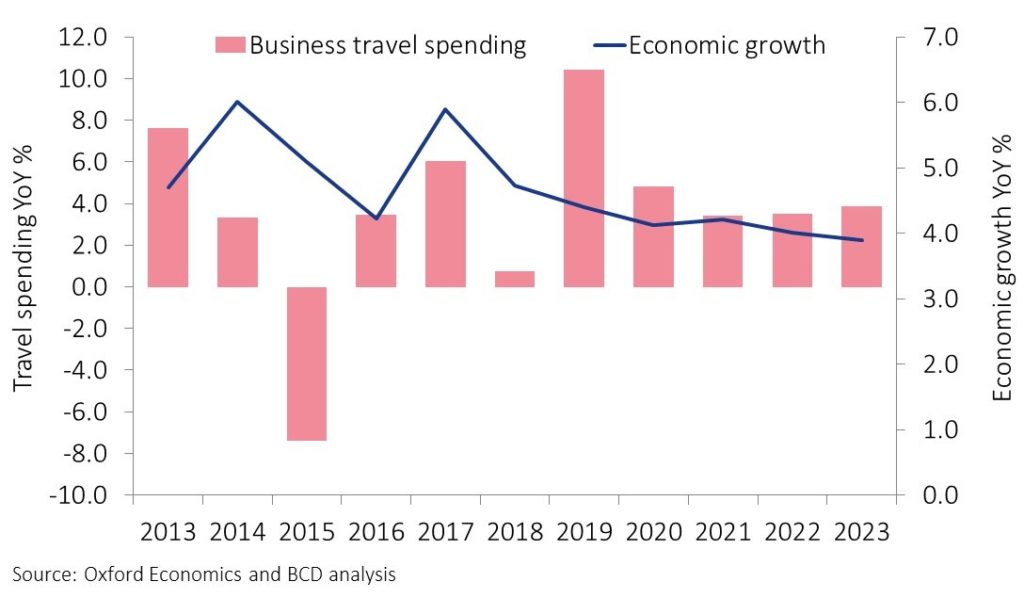

Economic growth and business travel spending

Click on image to enlarge

- Malaysia’s gross domestic product of more than US$354 billion made it Asia’s 10th-largest economy in 2018. It ranks below Singapore and Hong Kong but ahead of the Philippines.

- The economy is heavily dependent on exports, so the 2009 global recession had a big negative impact. A government-backed stimulus package limited the damage but left Malaysia heavily in debt.

- Since 2013, economic growth has been as high as 6% and as low as 4.7%, which was reported in 2018. Oxford Economics 4.4% growth in 2019 as import demand from China cools and global protectionism heats up.

- Rising inflation and the prospect of higher taxes and borrowing rates are likely to curb Malaysian consumers’ spending power.

Air

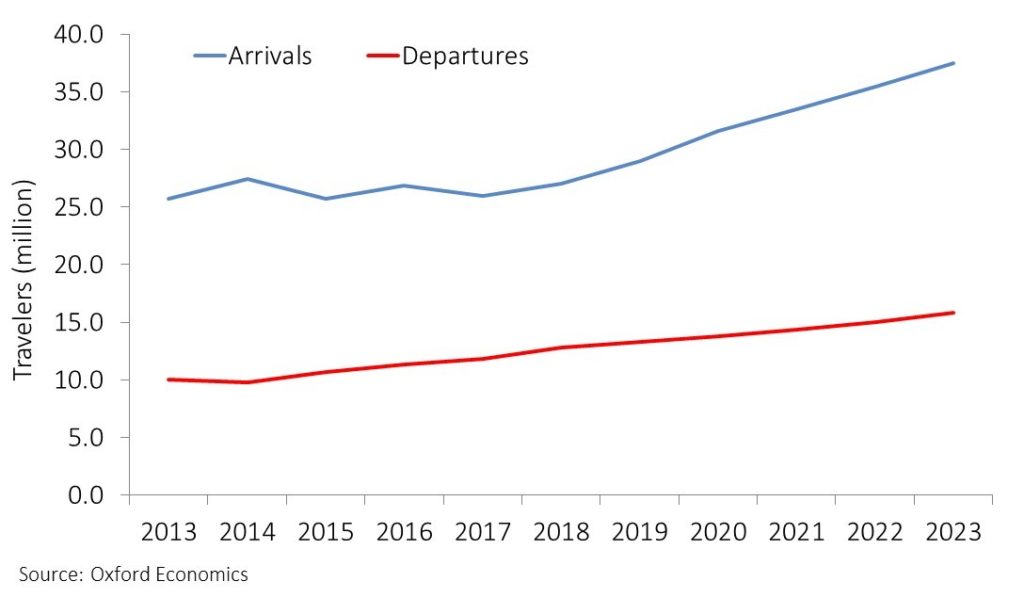

International travel

Click on image to enlarge

- Arrivals make up two-thirds of international travel, and resurgent inbound demand is expected to accelerate expansion to 6% a year through 2023.

- But the government’s planned Air Passengers Departure Levy could hamper growth. The International Air Transport Association estimates departures could shrink by 835,000 a year after the levy is in place.

- Singapore accounts for more than half of overnight trips to Malaysia. Thailand is the most popular destination for Malaysian travelers, accounting for a third of their trips.

- Malaysian low-cost carrier AirAsia is the leading operator in nine of Malaysia’s 10 largest air travel markets. It mainly offers short-haul flights, although its AirAsia X division offers long-haul flights from Kuala Lumpur to 27 destinations, mainly in Australia, China, India and South Korea.

- AirAsia’s main rival is Malaysia Airlines and its two regioanl divisions, FireFly and MASwings. Malindo Air, a subsidiary of Indonesian low-cost carrier Lion Air, is ramping up the competition.

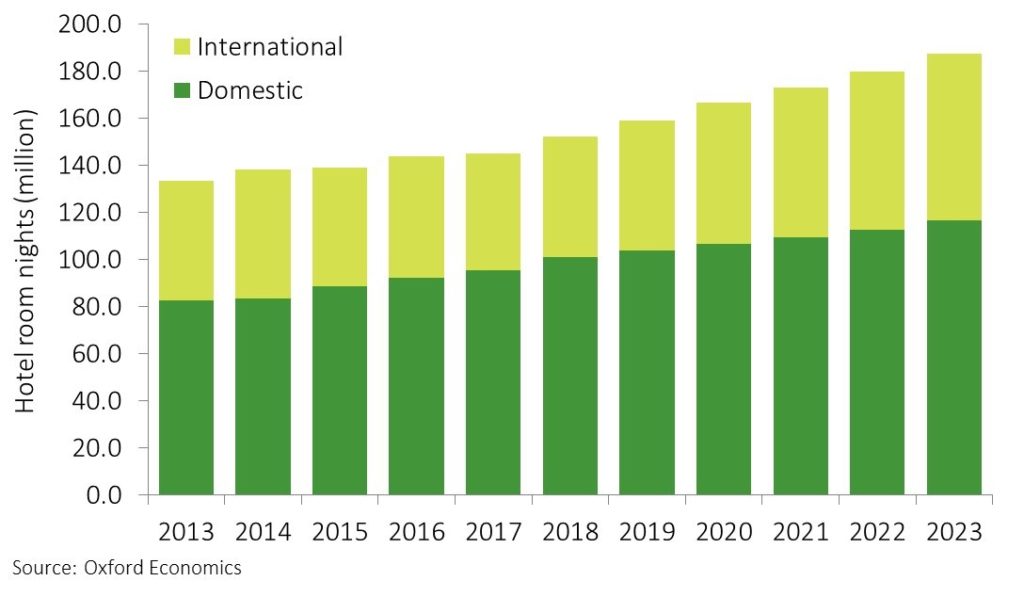

Accommodation

Hotel demand

Click on image to enlarge

- Between 2013 and 2018, demand for hotel accommodation in Malaysia increased by 14%, growing an average of 2.7% a year. Domestic travelers account for two thirds of demand.

- Annual growth is expected to strengthen to 4.3% through 2023 as international demand increases.

- Today, travelers arriving from Singapore account for almost half of international demand. Some of the strongest future demand is likely to come from travelers from China, the U.K. and India. Their room nights are expected to increase more than 10% a year through 2023.

- The four largest hotel chains are global. The market leader is Marriott with 29 properties mostly in the upper service tiers. Second-place Accor offers properties available in all tiers. Kuala Lumpur is the dominant location for both chains.

- Economy chain Tune Hotels is the largest local operator. Other Malaysian chains include Swiss-Garden International and Berjaya Hotels & Resorts.

- Virtual operators like India’s Oyo Rooms and Indonesia’s Zen Rooms offer lower-budget options.